Unlock the value of your assets

Experience the power of securitization, where innovation meets integrity. We go beyond traditional financial solutions, leveraging cutting-edge techniques and technologies to unlock the full potential of your assets.

Empowering financial growth through intelligent securitization

At Secura, we specialize in transforming illiquid financial assets into tradable securities, providing issuers with access to funding and investors with opportunities for portfolio diversification and risk-adjusted returns. Our streamlined process ensures efficiency, transparency, and compliance with legal and regulatory requirements.

Asset Selection

We begin by carefully selecting a pool of financial assets, such as mortgages, auto loans, credit card receivables, or corporate receivables. These assets have predictable cash flows and meet stringent quality criteria, making them suitable for securitization.

Pooling & Structuration

The selected assets are pooled together to form a diversified portfolio. We then structure these assets into different tranches or layers based on their risk and return characteristics. This allows us to tailor investment opportunities to meet the needs of a wide range of investors.

Issuance & Distribution

Once the structure is finalized and approvals are obtained, securities representing ownership interests in the underlying assets are issued to investors. We facilitate the distribution process through public offerings or private placements, ensuring optimal pricing and allocation.

Administration & Monitoring

Throughout the life of the securitization transaction, we provide ongoing servicing reporting and administration of the underlying assets. From collecting payments to managing delinquencies and defaults, we handle all aspects of asset management with efficiency and professionalism.

Global experts in regulatory and compliance

Our experienced team ensures full compliance with legal and regulatory requirements governing securitization. From securities laws to tax regulations and accounting standards, we handle all aspects of the process with precision and attention to detail.

Audit Trails

Data Encryption

API Access

Workflow Automation

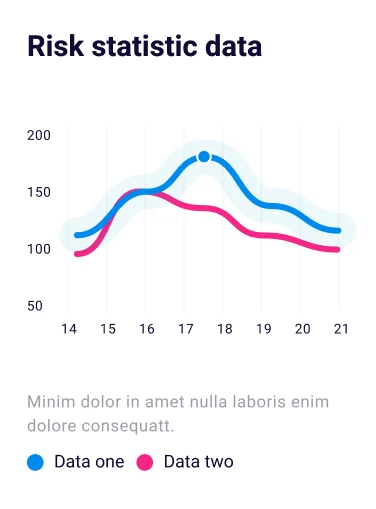

Risk managers at heart

Risk management is central to our approach. We identify, measure, and mitigate various risks associated with the underlying assets and the structure of the transaction, including credit risk, interest rate risk, liquidity risk, and operational risk.

- Super fast loading speed

- Cost-effective compliance

- Strong analytics

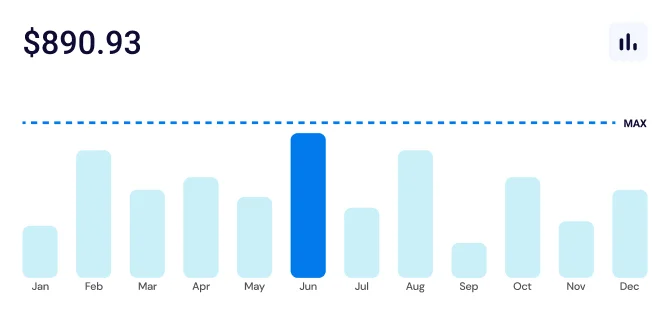

We offer Financial Management Tools.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Mattis turpis in suspendisse sed nisi risus. Nunc nulla adipiscing id augue libero. Suspendisse pellentesque nam mi tellus.

Currency Management

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque

Tax Management

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque

Cash Management

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque

Project Accounting

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque

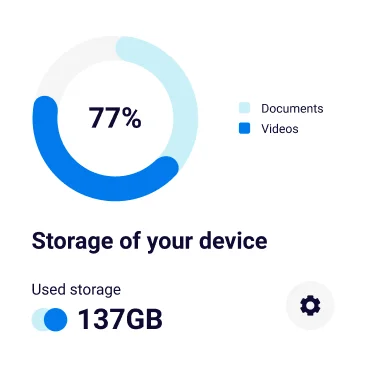

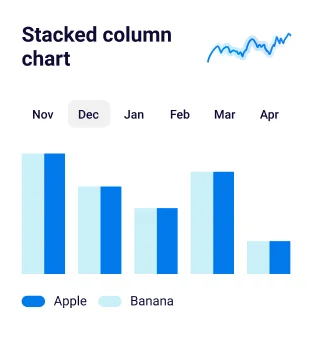

Data Analysis

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque

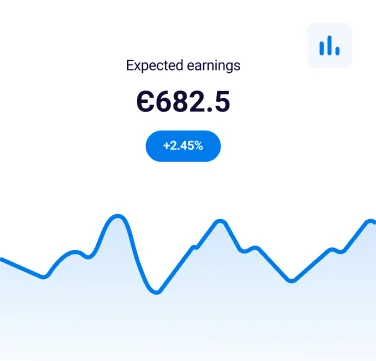

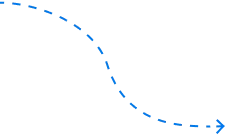

Dashboard

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque

Frequently Asked. Questions

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Mattis turpis in suspendisse sed nisi risus.

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam

Have you decided to work on a project with us?

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque.